Recurring Journals

Recurring Journals

Recurring Journals are profiles that you set up to auto-create manual journals at regular intervals. Setting up recurring journals helps you save time by automating manual journal creation. Let’s look at a few scenarios where Recurring Journals will be helpful to you.

Scenarios: Let’s say that you have an asset that depreciates in value year-on-year at a regular rate. Instead of creating a journal manually every year, you can create a recurring journal to debit the Depreciation account and credit the Asset account automatically every year.

In another scenario, you could be creating manual journals to record the employee wages every week or every month. Using recurring journals, you can automate this process so that the employee wages are recorded as a journal every week or month. Similarly, you might be creating manual journals to record loan repayments on a monthly basis. You can create a recurring journal and automate it.

Consider another scenario where you create a manual journal every month to round-off the amount in accounts for tax purposes. You can set up a recurring profile to create a manual journal automatically and save it as draft. You can review the debit and credit values and publish the manual journal.

IN THIS PAGE…

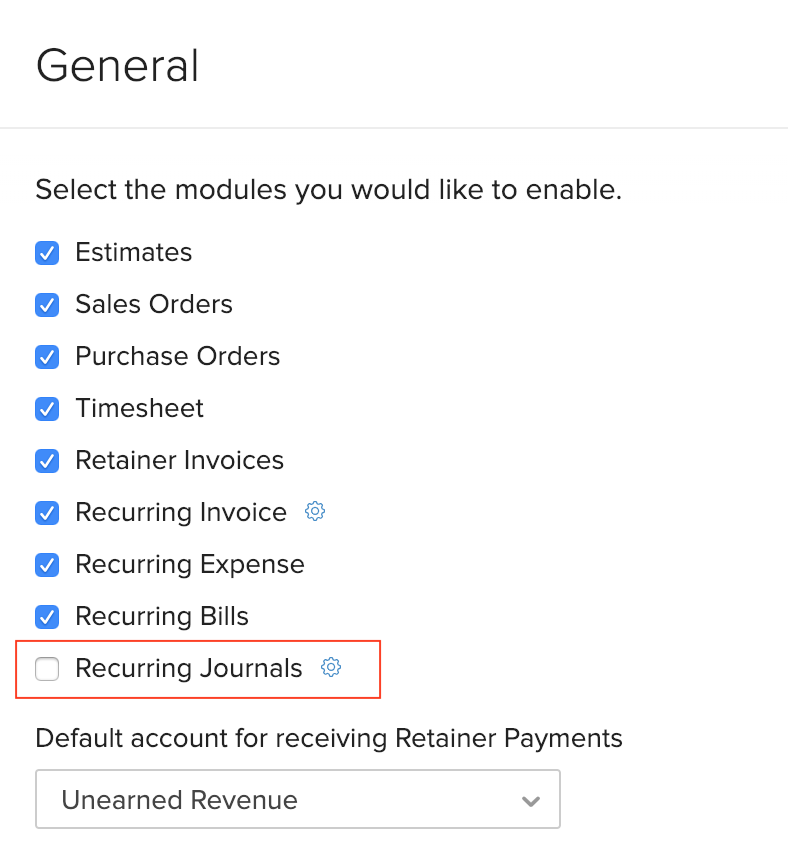

Enable Recurring Journal

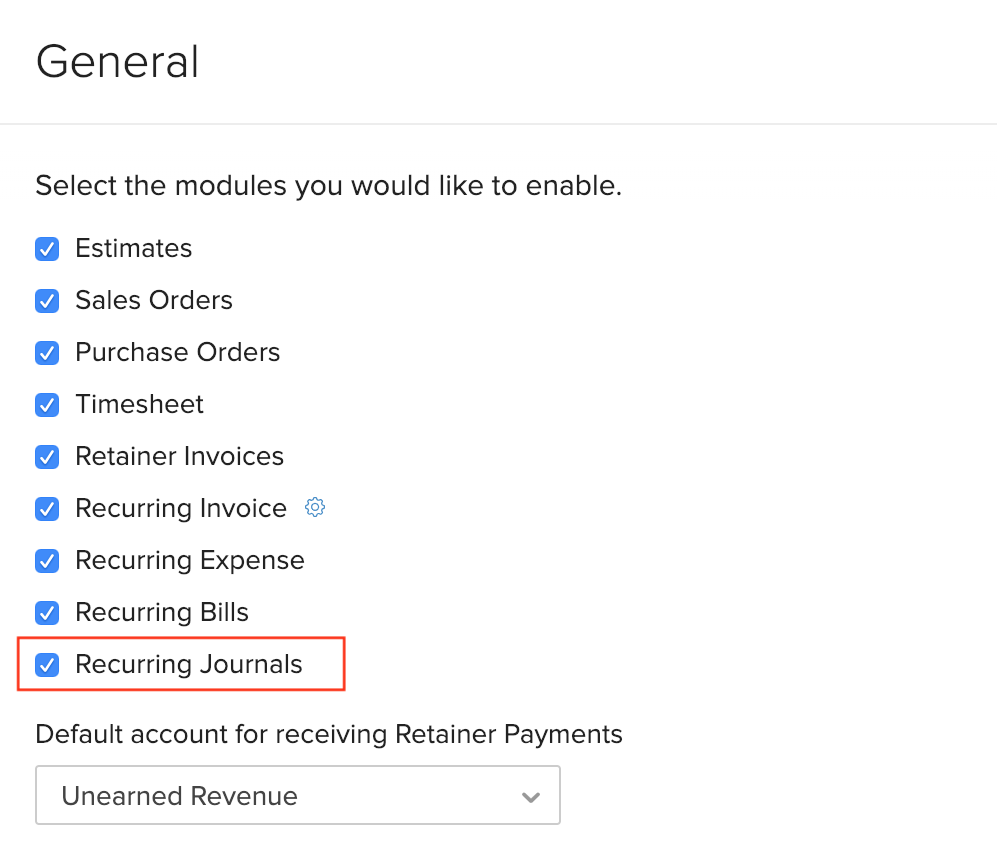

Before you start creating a recurring journal, you will need to enable it for your organization. To enable:

- Go to Settings on the top right corner of the page.

- Select General under Preferences.

- Check the Recurring Journals option to enable it.

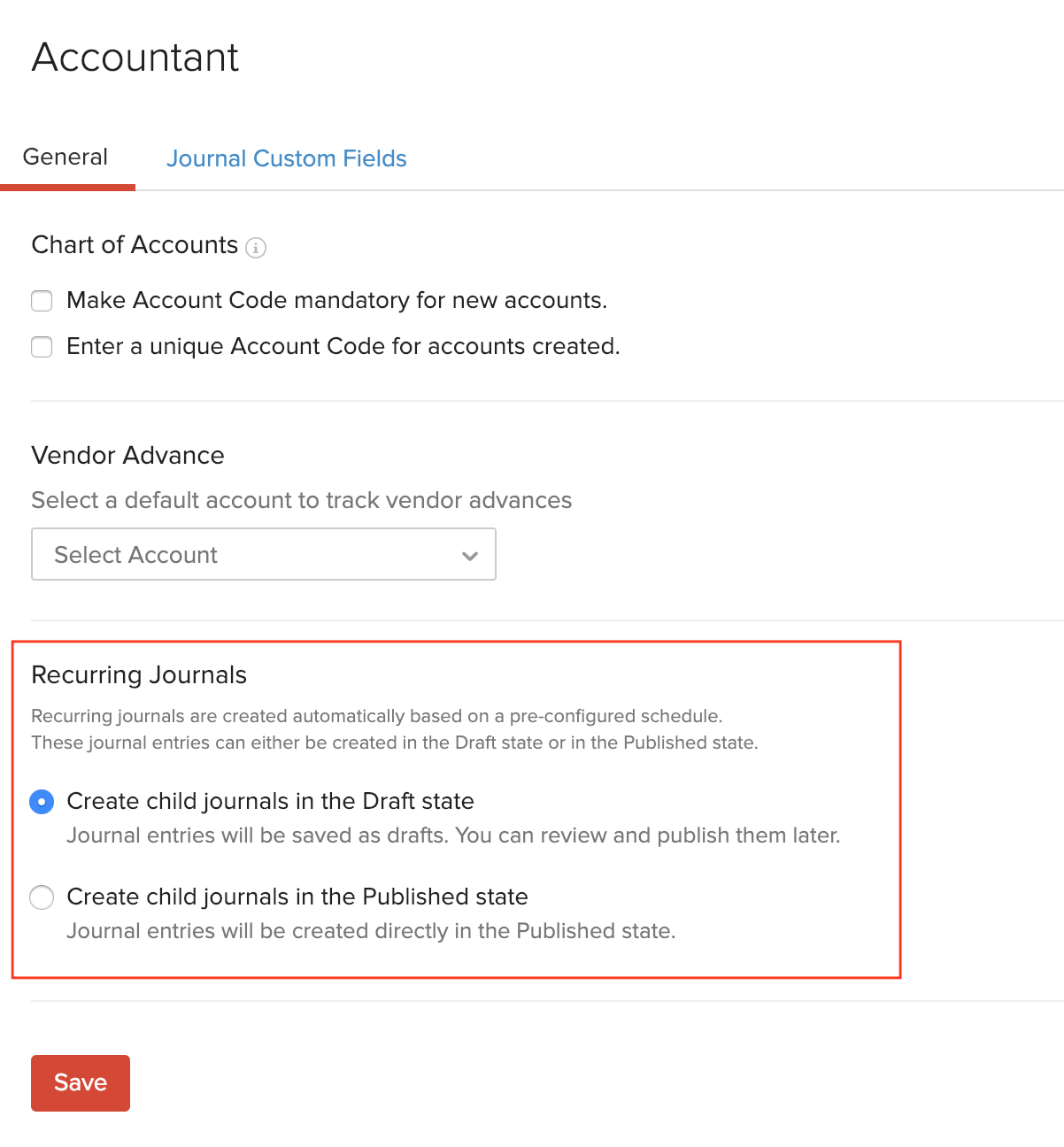

Also, you can configure if the recurring journals that are created should be saved in Draft state or in Published state. To configure recurring journal preferences:

- Go to Settings on the top right corner of the page.

- On the page that appears, select Accountant under Preferences.

- Choose the option under the Recurring Journals section.

As soon as you enable, a new Recurring Journals tab will be available under the Accountant module on the left sidebar.

Create Recurring Journal

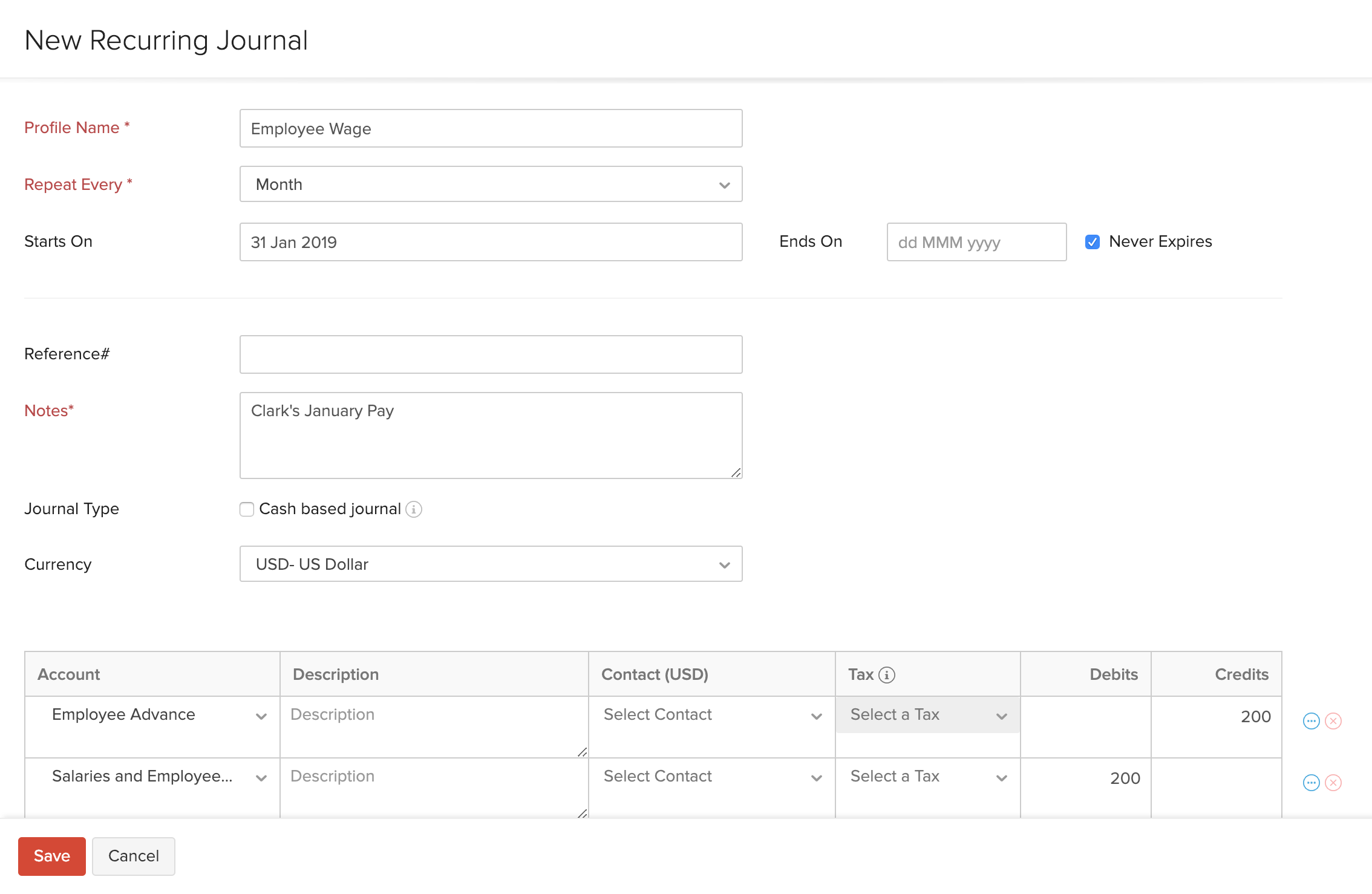

After you enable recurring journals for your organization, you can set up recurring journals. Here’s how:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Click + New in the top right corner.

- Enter a Profile Name.

- Select the frequency of the recurring journal under the Repeat Every dropdown. If you want to configure a custom frequency, scroll to the end of the dropdown, select Custom, and configure them.

- Select the Start Date and End Date for the recurring journal.

Insight: If you select the Start Date in the past, remember that recurring journals will not be created for the past periods. They will be created only from the next recurring date.

- Enter notes relating to the recurring profile.

- Fill in the other details.

- Select the accounts and enter the credit and debit amount. Ensure that the credit and debit values are equal.

- If you’ve configured any reporting tag, click the More icon at the right side of the journal entry and select the necessary reporting tag.

- Click Save.

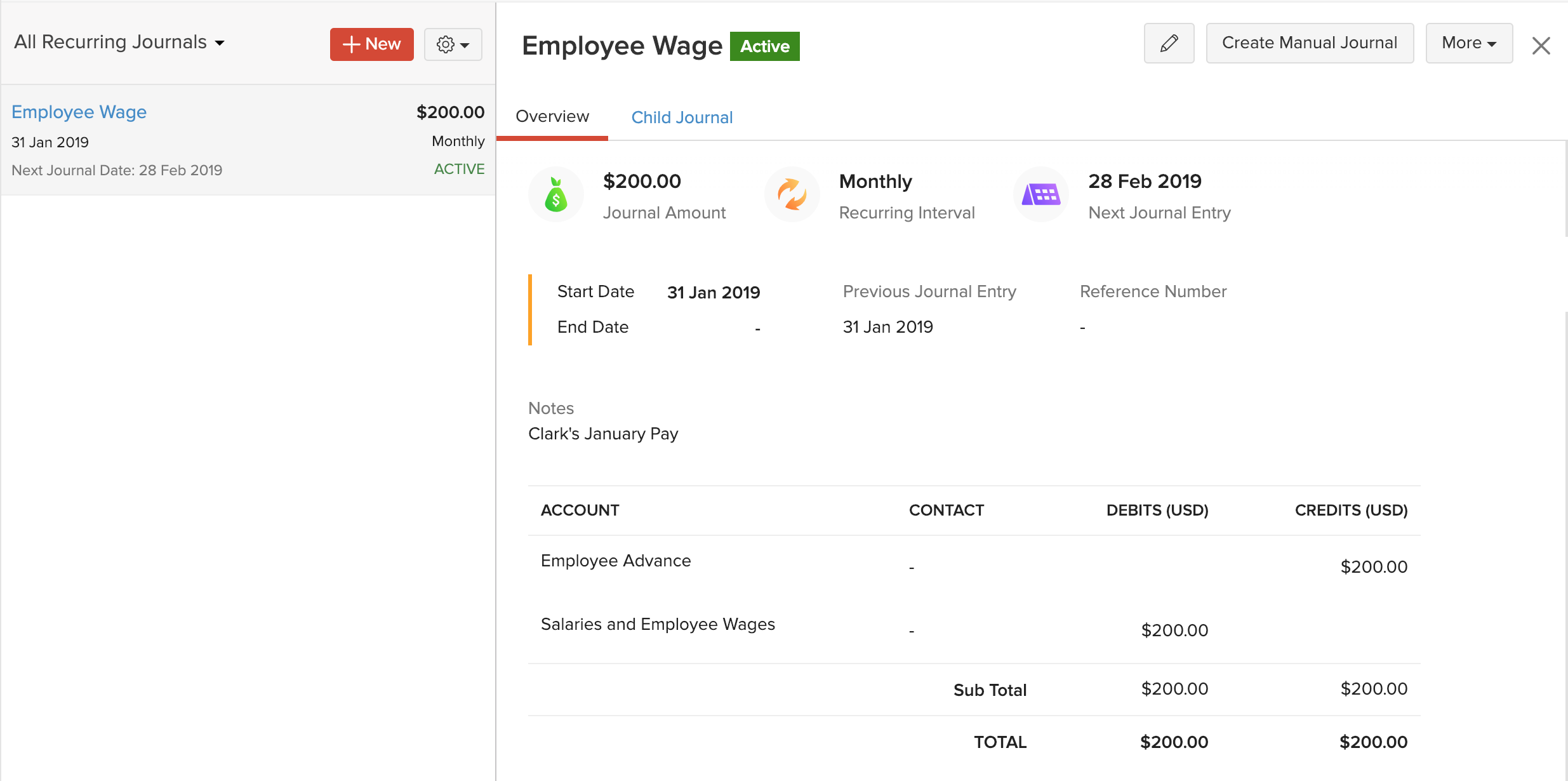

You’ll see the Overview page of the recurring journal where the details will be displayed. You can click the Child Journals tab to view all the individual journals that were auto-created.

Import Recurring Journals

You might want to import recurring journals if you were using recurring journals in another system. To import:

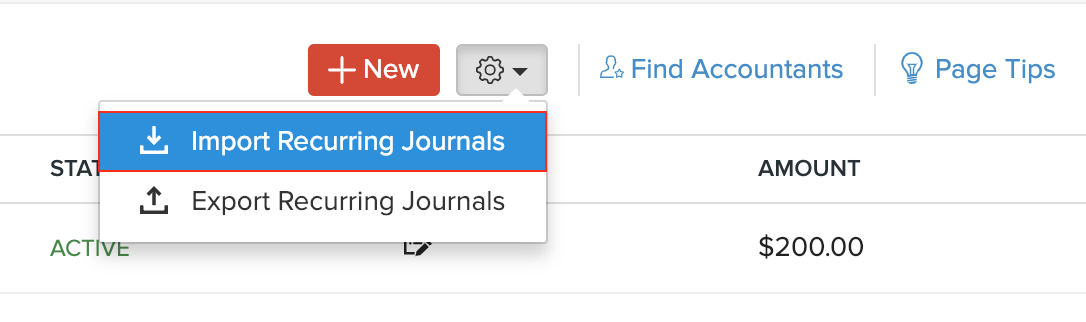

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Click the More button in the top right corner.

- Select Import Recurring Journals.

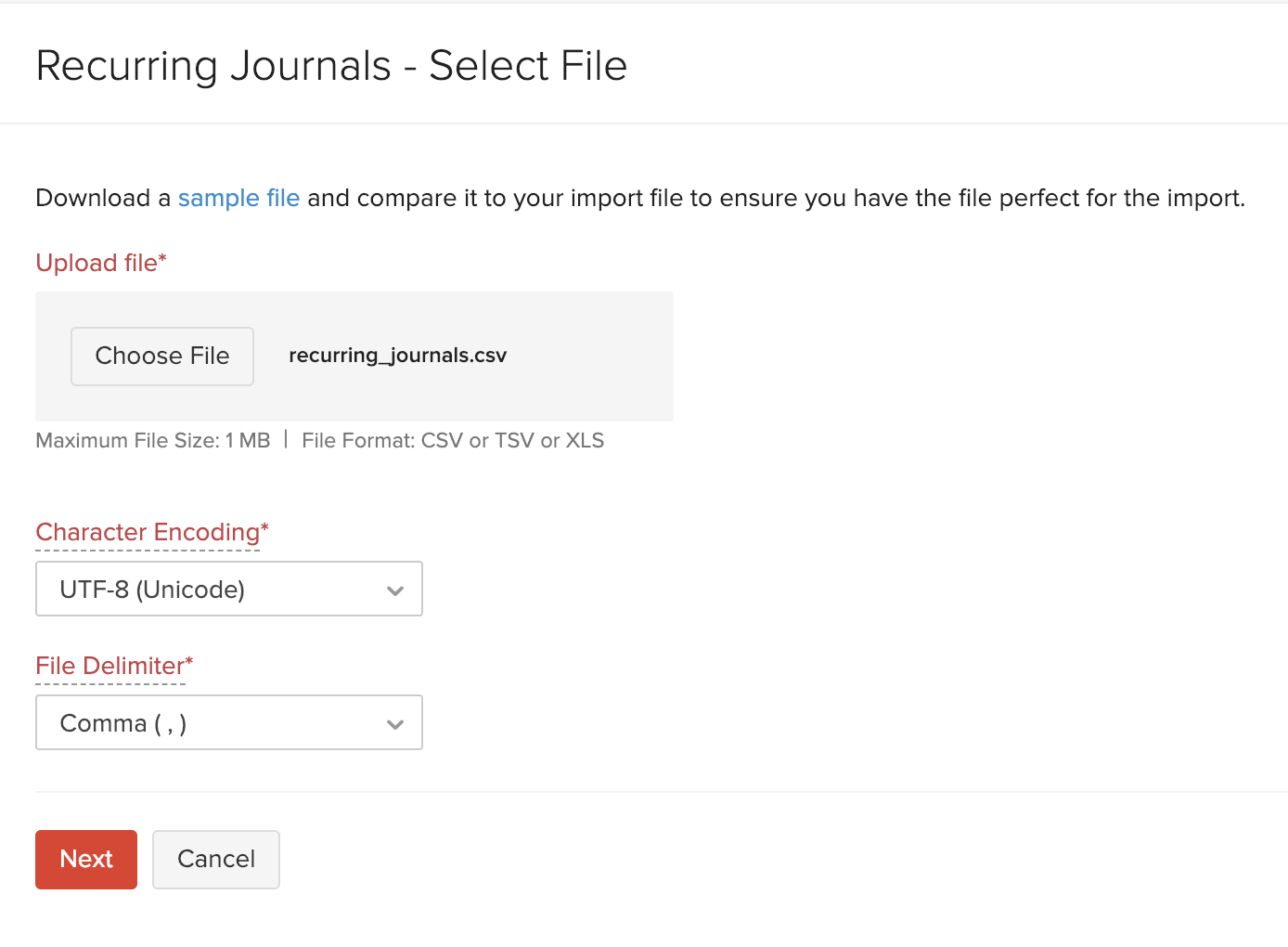

- Click Choose File and select the import file. You can import a CSV (Comma Separated Value), a TSV (Tab Separated Value) or an XLS (Excel Spreadsheet) file from your system.

Pro Tip: Download the sample file and ensure that the import file is in the same format, to import without any errors.

- Select the Character Encoding and File Delimiter based on your import file.

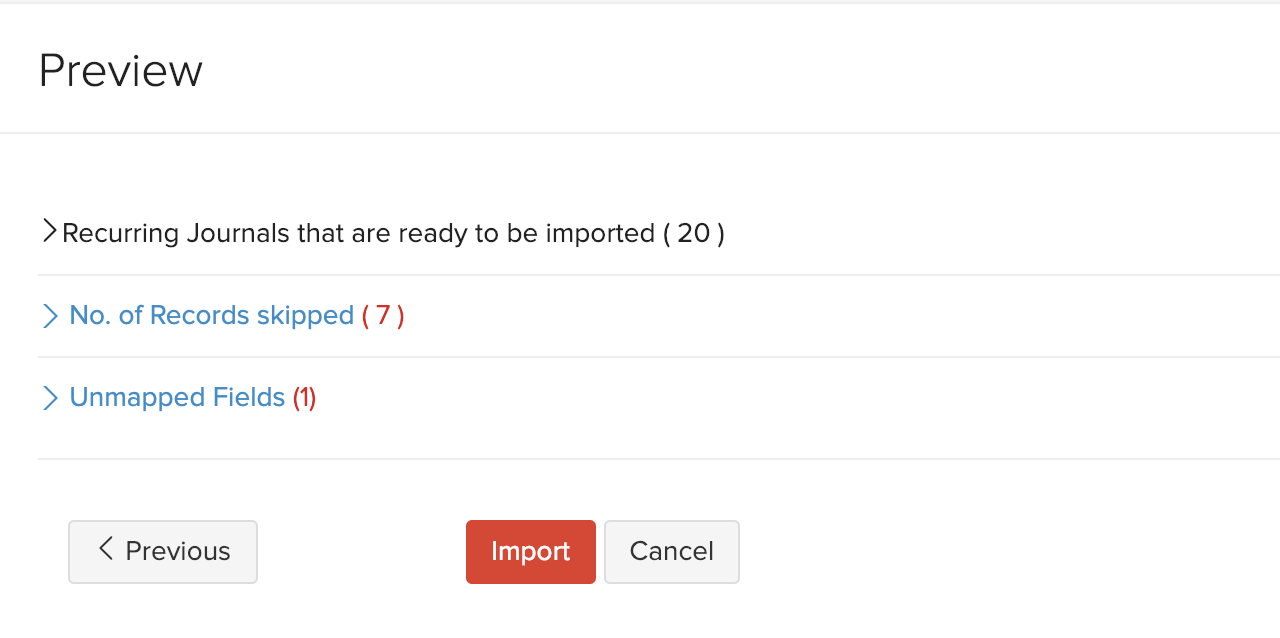

- Map the fields in Zoho Books with the fields in the import file and click Next.

- Verify the preview and click Import.

The recurring journals will be imported into Zoho Books.

Edit Recurring Journal

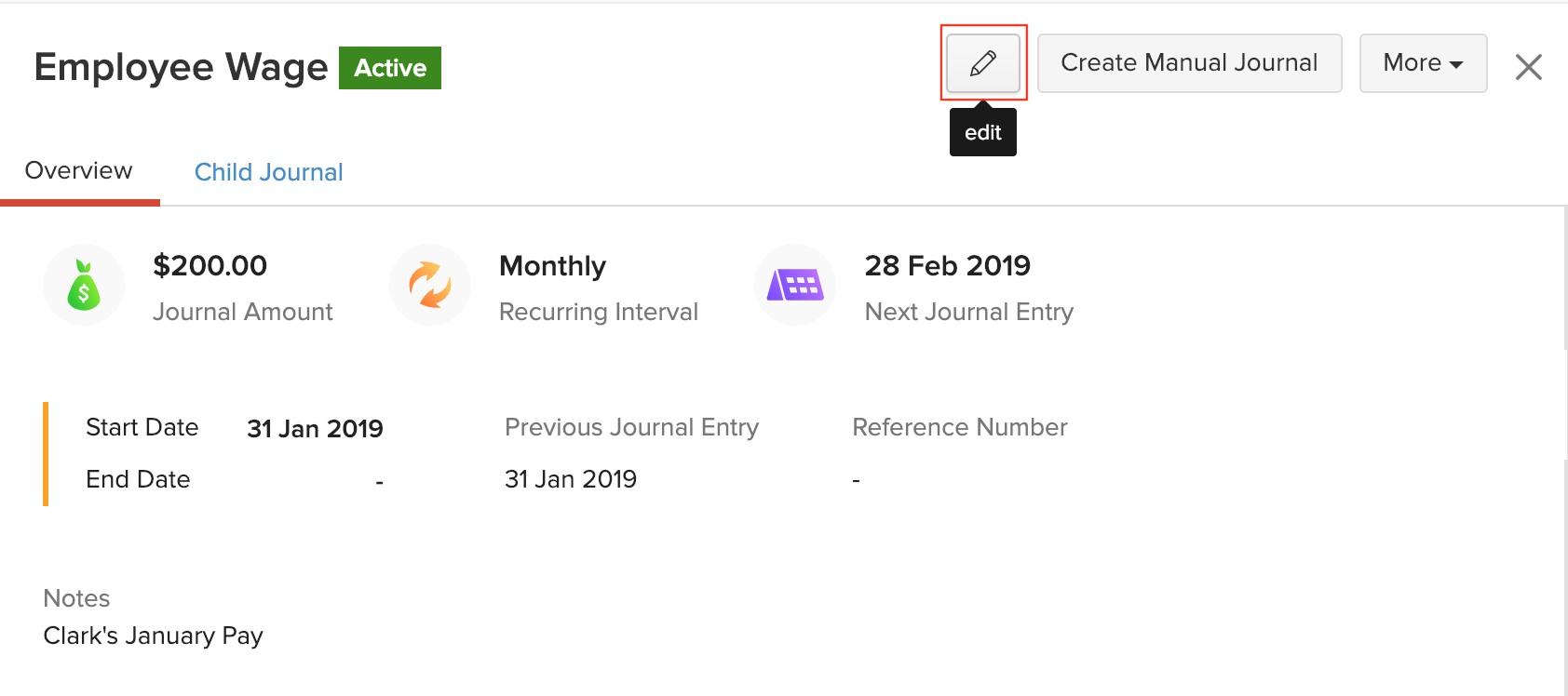

You can edit the recurring journal if you want to change the recurring frequency, dates or the accounts. The child journals that were generated previously will remain unaffected. To edit:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Select the recurring journal that you want to edit.

- Click the Edit icon in the top right corner.

- Make the changes to the recurring profile and click Save.

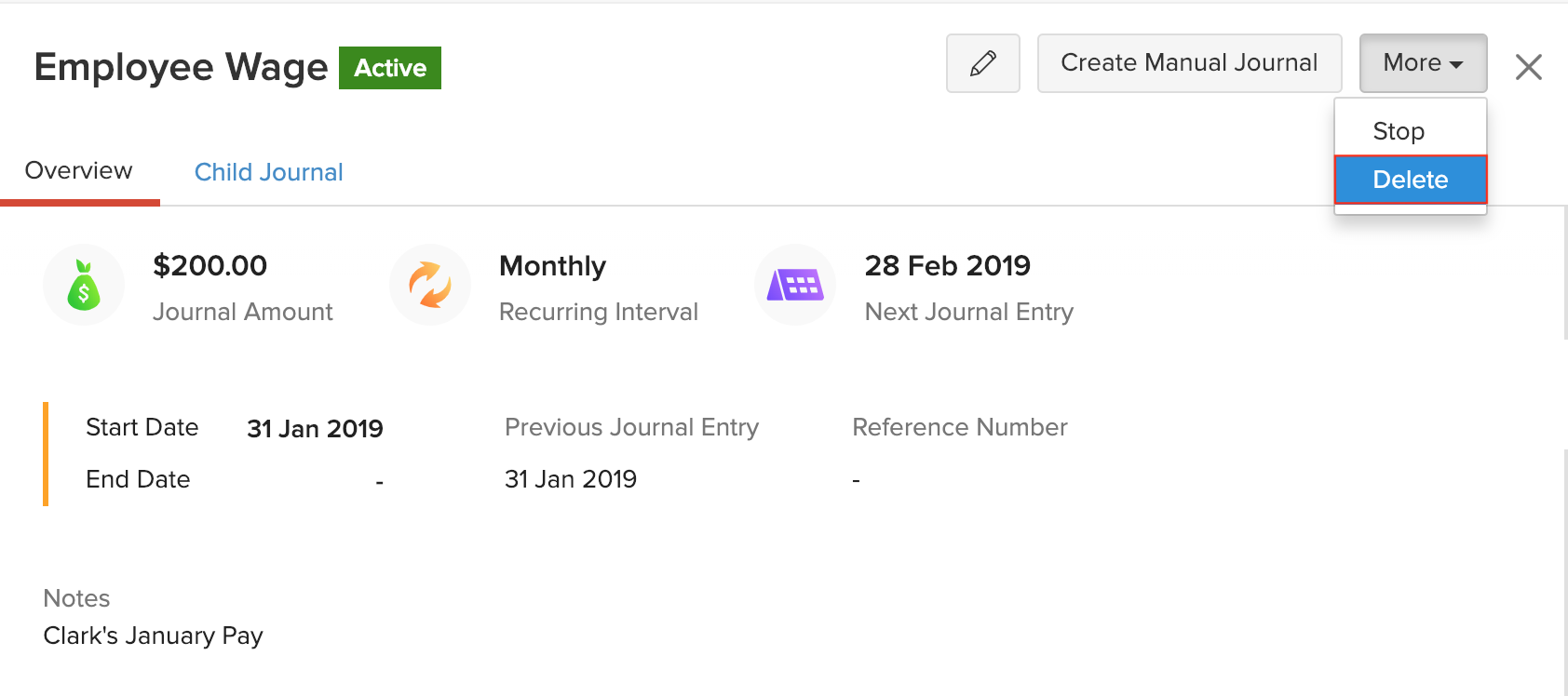

Delete Recurring Journal

If you want to stop the recurring profile permanently and remove the recurring journal, you can delete it. However, the child journals that were created for the recurring journal will be available under Manual Journals tab. To delete:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Select the recurring journal that you want to delete.

- Click the More dropdown in the top right corner and click Delete.

More Actions

- Create Manual Journal from Recurring Journal

- Stop Recurring Journal

- Export Recurring Journals

- Disable Recurring Journals

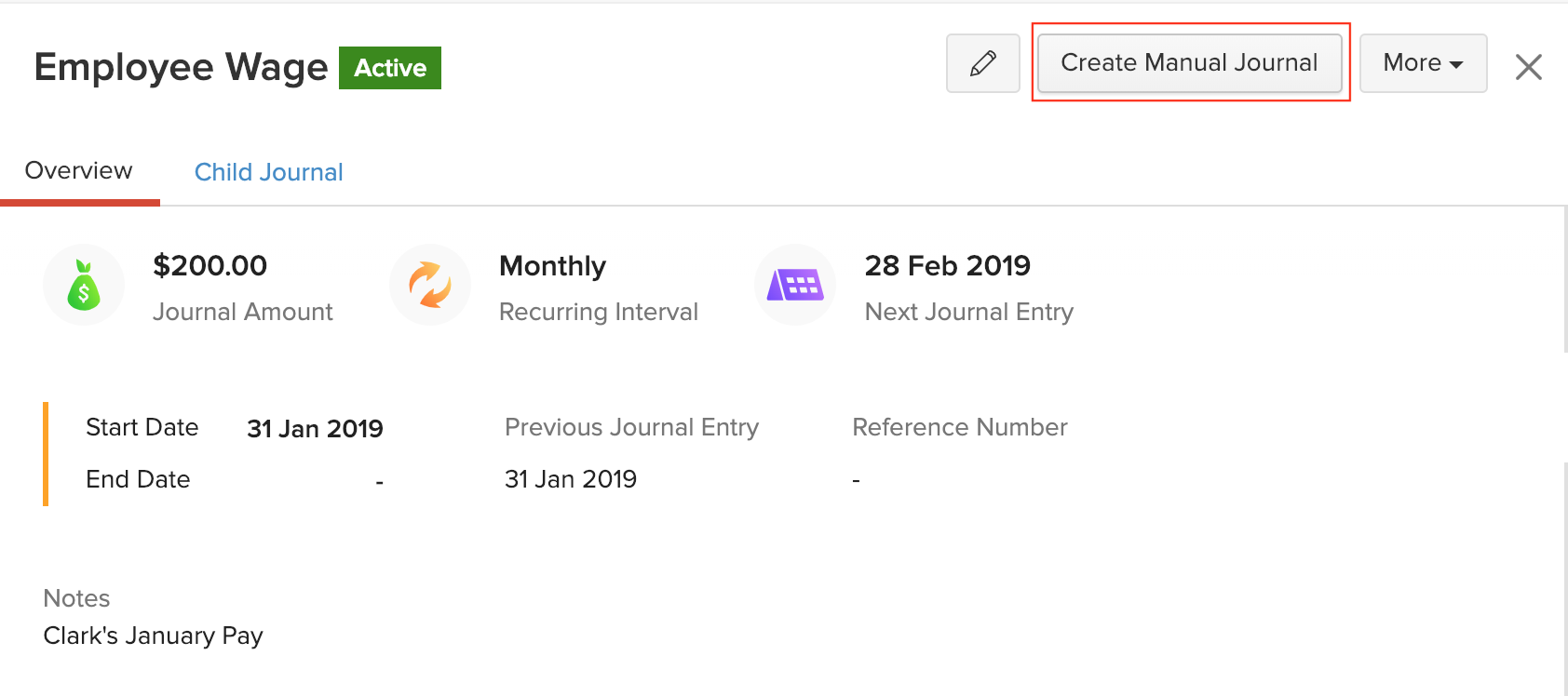

Create Manual Journal from Recurring Journal

You can create a manual journal from the recurring profile. This allows you to clone the details of the recurring profile into the manual journal so that you don’t have to enter the same details again. Here’s how:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Select a recurring journal and click Create Manual Journal in the top right corner.

- Click OK in the pop-up.

- Edit details if you need to and click Save and Publish or Save as Draft.

The journal will be listed along with the manual journals.

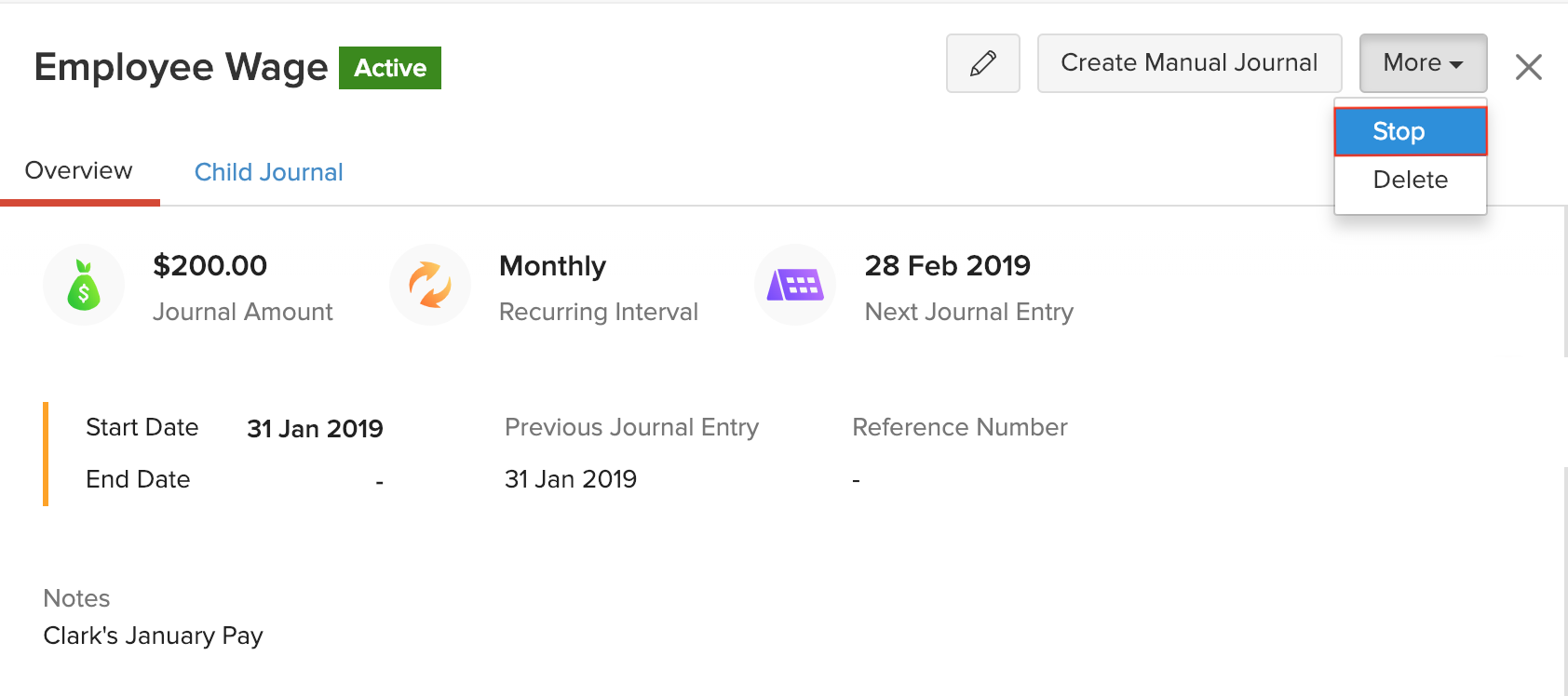

Stop Recurring Journal

You can stop a recurring journal if you don’t want to auto-create journals. You may want to do this because you’ve sold the asset for which you were recording depreciation or for any other reasons. To stop:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Select the recurring journal that you want to stop.

- Click the More dropdown at the top right corner and click Stop.

Once you stop a recurring journal, child journals will not be created any more. You can resume a stopped recurring journal by repeating the steps mentioned above.

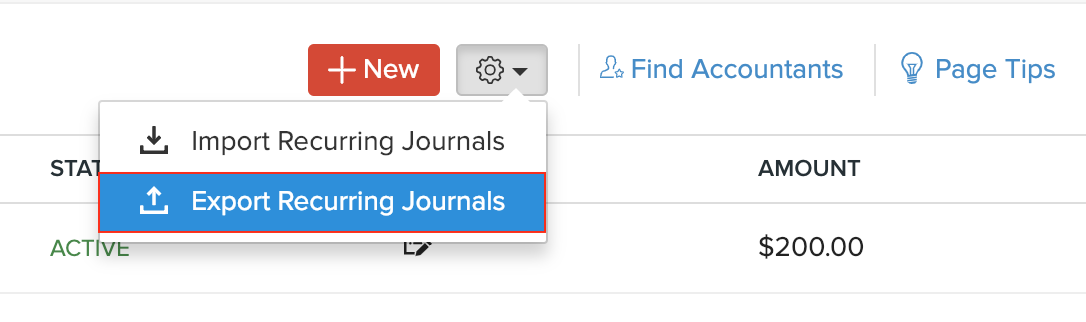

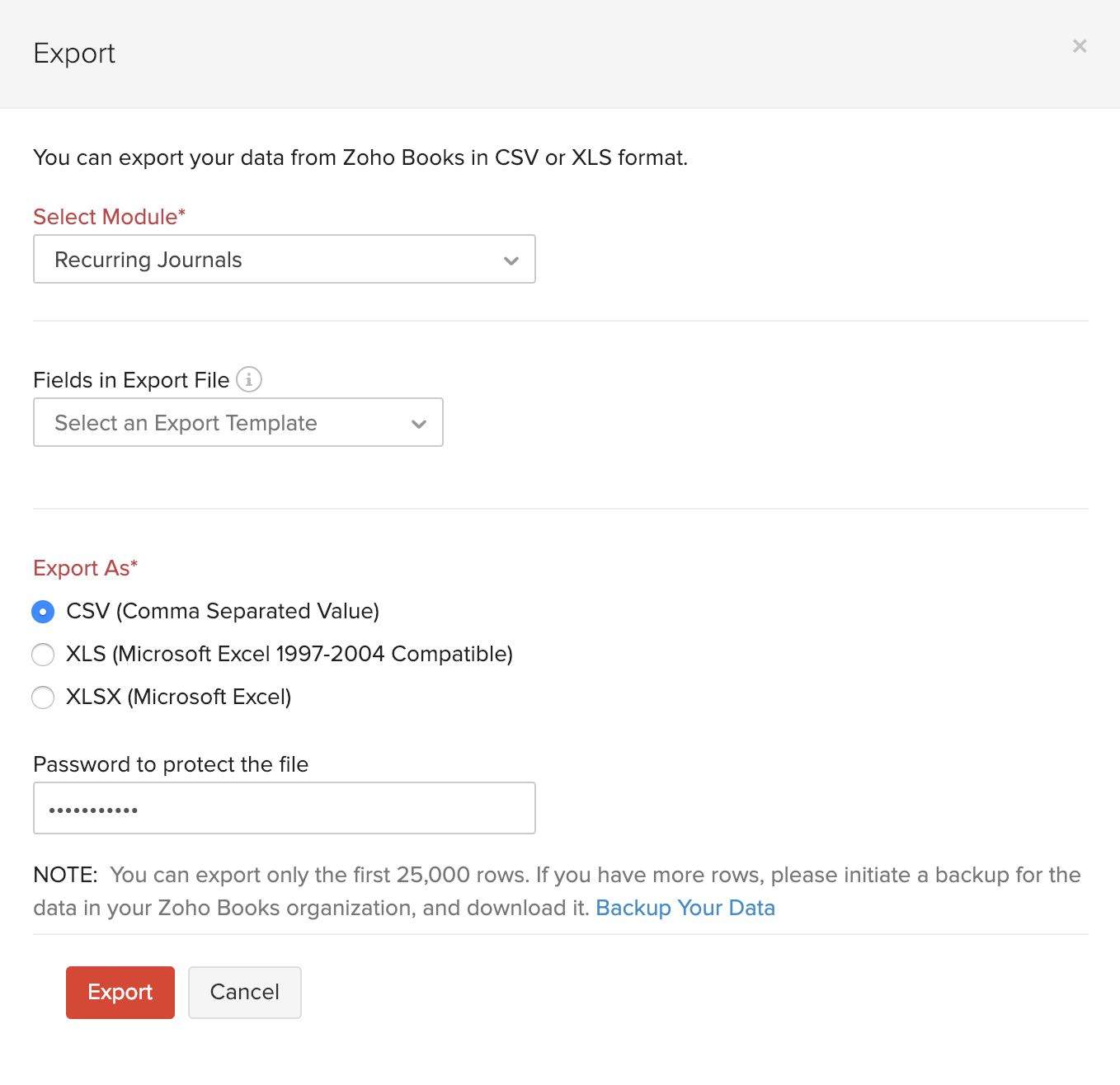

Export Recurring Journals

You can export recurring journals easily if you want to keep a copy of the recurring journals or back up recurring journals. To export:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Click the Gear icon in the top right corner.

- Select Export Recurring Journals.

- Click the Fields in Export File dropdown and create a template if you want to export only specific fields of the recurring journals (optional).

- Select the file format in which you want to export.

- Enter a password to protect the file that you’re exporting (optional).

- Click Export.

- Click Save and the exported file will be downloaded into your system.

Disable Recurring Journals

You can disable recurring journals for your organization. However, you must ensure that there are no active recurring journals. To disable:

- Go to the Accountant module in the left sidebar and select Recurring Journals.

- Uncheck the option Recurring Journals to disable it.

- Click Save.

Recurring Journals will be disabled for your organization and you won’t find the Recurring Journals tab on the left sidebar.

Related Articles

Fixed Assets

Fixed Assets Fixed assets are long-term tangible assets that a business owns and uses to produce goods and services. These assets cannot be quickly converted into cash. Instead, they serve the business in the long run by generating profitable ...How do I record an asset depreciation?

How do I record an asset depreciation? To record a depreciation amount for an asset, you can create a recurring journal profile and set them to recur based on your preference. To do this: Click the Accountant tab on the left sidebar and go to ...How do I record an asset depreciation?

To record a depreciation amount for an asset, you can create a recurring journal profile and set them to recur based on your preference. To do this: Click the Accountant tab on the left sidebar and go to Recurring Journals. Click + New in the top ...Opening Balances

Opening Balances Any business that has recently switched to Zoho Books from another accounting software or from manually maintained books of accounts, will have to ensure that all details from the previous accounts are brought in. This includes all ...Reverse Charge

Usually, vendors pay taxes to the government for selling goods or services. Reverse Charge is a mechanism by which the customer is liable to pay the tax directly to the government for goods or services that fall under Reverse Charge as specified by ...