How do I record an asset depreciation?

How do I record an asset depreciation?

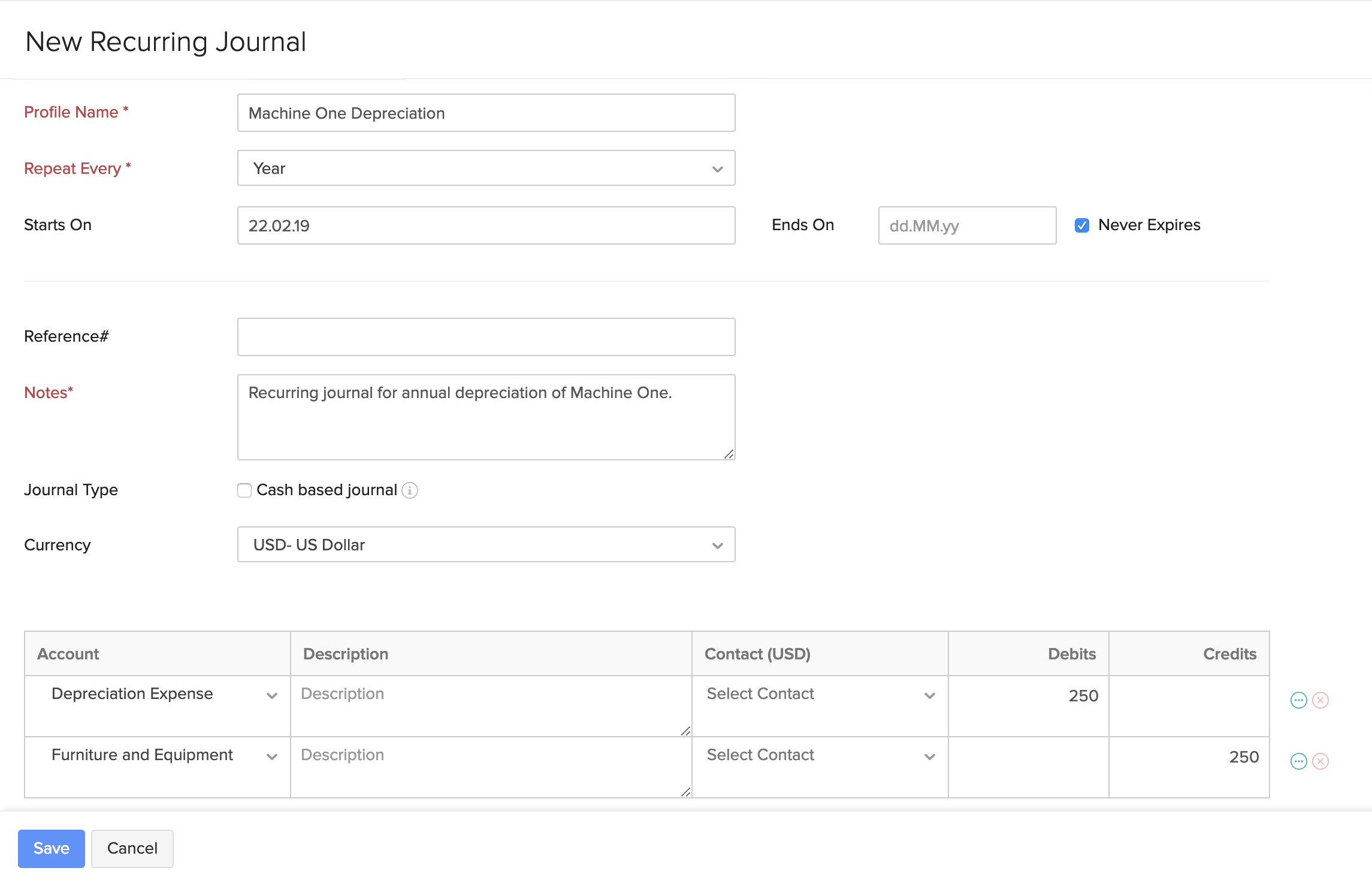

To record a depreciation amount for an asset, you can create a recurring journal profile and set them to recur based on your preference. To do this:

- Click the Accountant tab on the left sidebar and go to Recurring Journals.

- Click + New in the top right side of the page.

- Enter the Profile Name.

- Give a short note for the journal entry and add other necessary details.

- Select the frequency of the recurring journal under the Repeat Every dropdown.

Insight: You can also enter a frequency of your choice by choosing Custom from the dropdown.

Select Depreciation Expense as the Debit account and the account under which the asset was recorded as the Credit account.

Click Save and Publish or Save as Draft to record the asset depreciation.

Based on the preferences you have set for the recurring journal, the child journals that are created will be saved in the Draft or Published status. All the child journals will be available as journals under Manual Journals.

Related Articles

Recurring Journals

Recurring Journals Recurring Journals are profiles that you set up to auto-create manual journals at regular intervals. Setting up recurring journals helps you save time by automating manual journal creation. Let’s look at a few scenarios where ...Fixed Assets

Fixed Assets Fixed assets are long-term tangible assets that a business owns and uses to produce goods and services. These assets cannot be quickly converted into cash. Instead, they serve the business in the long run by generating profitable ...How do I record an asset depreciation?

To record a depreciation amount for an asset, you can create a recurring journal profile and set them to recur based on your preference. To do this: Click the Accountant tab on the left sidebar and go to Recurring Journals. Click + New in the top ...Record Bulk Payments

Record Bulk Payments Filter and record payments you’ve made towards various bills at once using bulk payments. You can record payments made to the same vendor or multiple vendors. Here’s how you can: Go to Purchases > Bills. Filter your bills by ...Opening Balances

Opening Balances Any business that has recently switched to Zoho Books from another accounting software or from manually maintained books of accounts, will have to ensure that all details from the previous accounts are brought in. This includes all ...