TDS

Tax Deducted at Source (TDS) is applied to a transaction when you deduct tax from the amount that must be paid to the vendor or collected from the customer and then send it to the government. In Zoho Books, you can enable TDS for your customers and vendors. Here’s how:

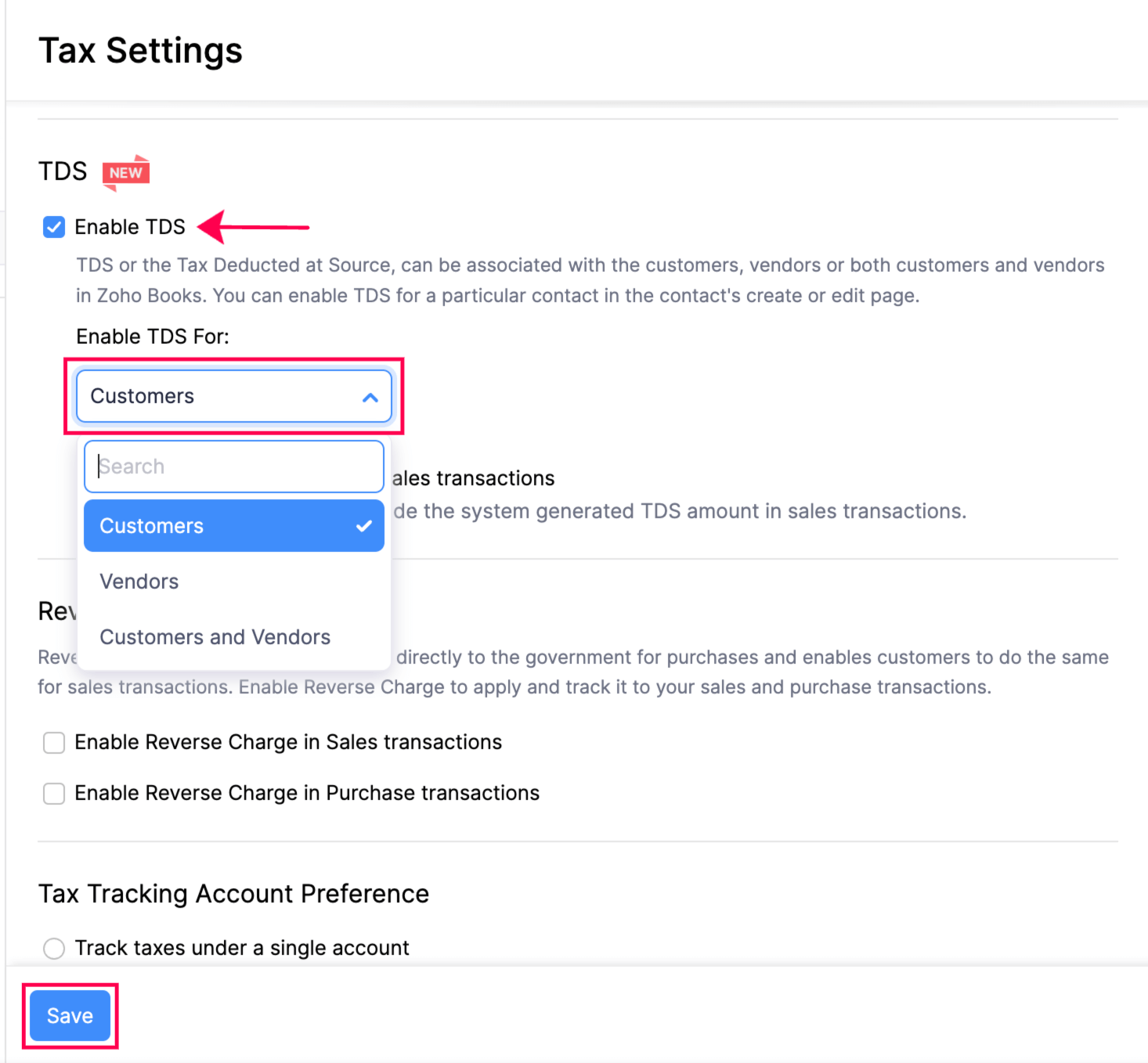

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Settings.

- Check the Enable TDS box.

- Select Customers, Vendors, or Customers and Vendors from the Support TDS For dropdown to enable TDS.

- Click Save.

You can now enable TDS for your contacts and apply it in transactions.

Note: To enable TDS for a specific contact, go to the TDS section while editing or creating a contact, and check the Enable TDS for this Customer/Vendor box.

Related Articles

Reverse Charge

Usually, vendors pay taxes to the government for selling goods or services. Reverse Charge is a mechanism by which the customer is liable to pay the tax directly to the government for goods or services that fall under Reverse Charge as specified by ...How do I record an asset depreciation?

To record a depreciation amount for an asset, you can create a recurring journal profile and set them to recur based on your preference. To do this: Click the Accountant tab on the left sidebar and go to Recurring Journals. Click + New in the top ...Price Lists

Price Lists Businesses have different strategies to sell products, some of which include giving discounts to loyal customers, or providing seasonal discounts on products. With Price Lists, you can set custom rates for the items that you buy from your ...Tax Settings

In Zoho Books, you can configure how the taxes should be tracked. Let’s take a look at them. TDS Tax Deducted at Source (TDS) is applied to a transaction when you deduct tax from the amount that must be paid to the vendor or collected from the ...Automatic Banking Feeds

Add Accounts In the Banking module, you can add your Bank, Credit Card and your PayPal accounts to Zoho Books. Once you add an account, you can import its feeds (automatically or manually) into Zoho Books. After doing this, you will be able to match ...