Reverse Charge

Usually, vendors pay taxes to the government for selling goods or services. Reverse Charge is a mechanism by which the customer is liable to pay the tax directly to the government for goods or services that fall under Reverse Charge as specified by your government.

Enable Reverse Charge

You’ll have to enable Reverse Charge for your organization to apply them to your transactions.

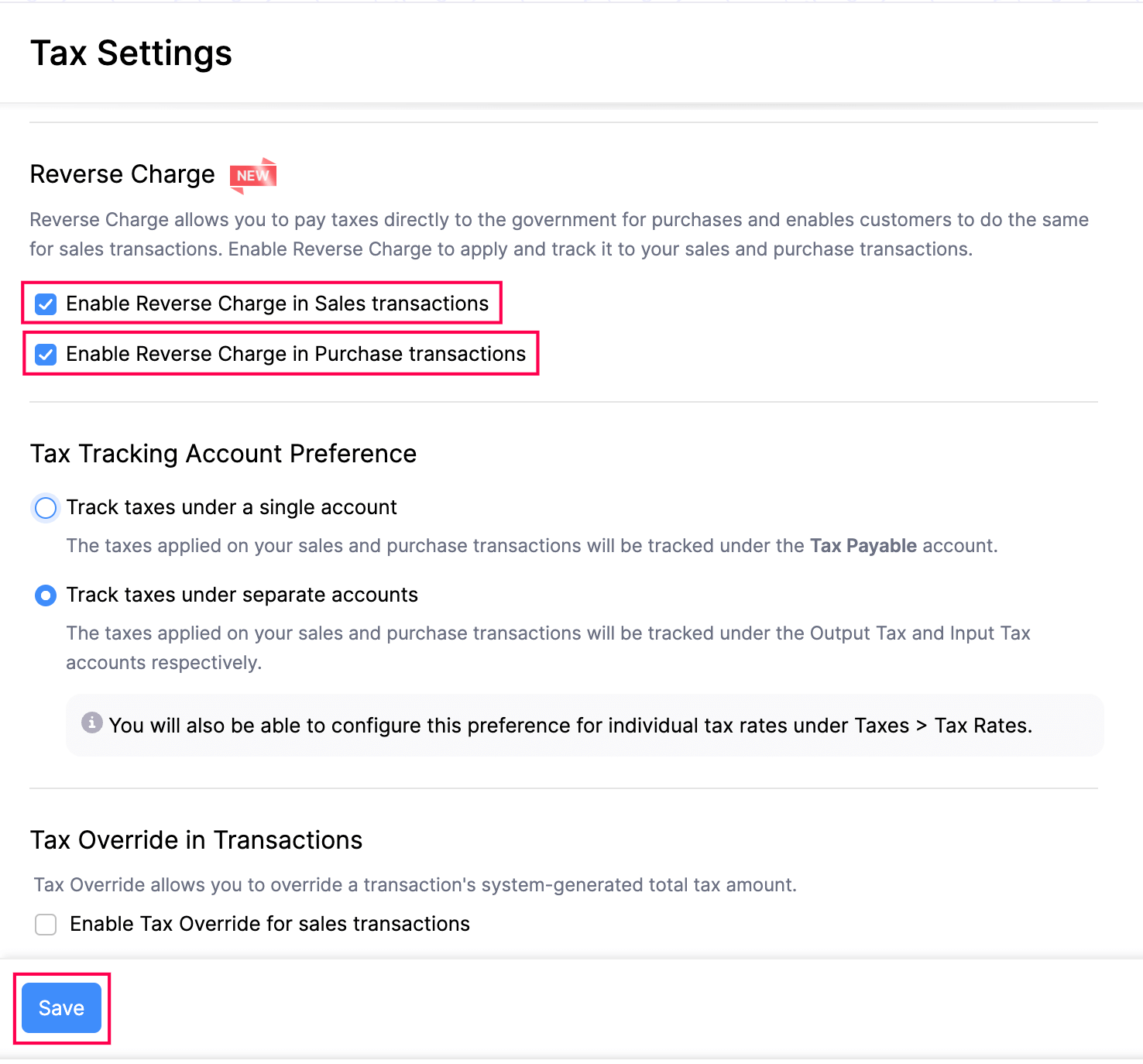

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Settings.

- Select the Enable Reverse Charge in Sales transactions checkbox to record reverse for invoices, recurring invoices, quotes, and credit notes.

- Select the Enable Reverse Charge in Purchase transactions checkbox to record reverse for expenses, recurring expenses, bills, recurring bills, and vendor credits.

- Click Save.

Warning: You cannot disable Reverse Charge once you have applied them to transactions.

Apply Reverse Charge to a Transaction

Once you have enabled Reverse Charge, you can apply them to transactions. Here’s how you can do this:

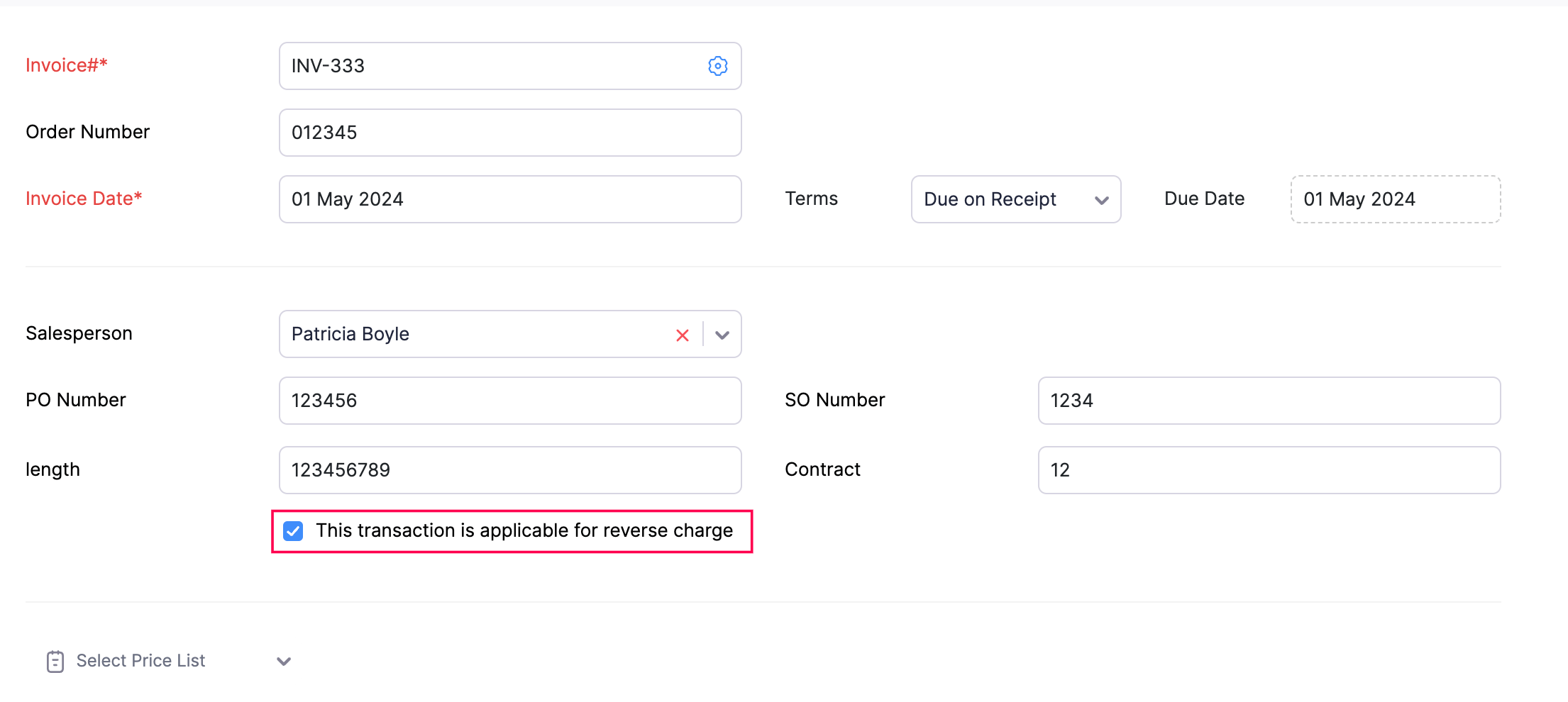

- Go to the transaction’s creation page.

- Click + New to create a new transaction.

- Enter the transaction details.

- Select the This transaction is applicable for reverse charge checkbox.

- Click Save.

Once you apply reverse charge to transactions, you can view the details in the Reverse Charge Summary report and Sales Reverse Charge Summary report.

Related Articles

Tax Settings

In Zoho Books, you can configure how the taxes should be tracked. Let’s take a look at them. TDS Tax Deducted at Source (TDS) is applied to a transaction when you deduct tax from the amount that must be paid to the vendor or collected from the ...TDS

Tax Deducted at Source (TDS) is applied to a transaction when you deduct tax from the amount that must be paid to the vendor or collected from the customer and then send it to the government. In Zoho Books, you can enable TDS for your customers and ...Price Lists

Price Lists Businesses have different strategies to sell products, some of which include giving discounts to loyal customers, or providing seasonal discounts on products. With Price Lists, you can set custom rates for the items that you buy from your ...Opening Balances

Opening Balances Any business that has recently switched to Zoho Books from another accounting software or from manually maintained books of accounts, will have to ensure that all details from the previous accounts are brought in. This includes all ...Navigating Zoho Books (Sales)

Zoho Books Welcome Guide Navigating Zoho Books To make it easier for you, we've put together the shortest route to navigate your way around Zoho Books. Before we get into the specifics, see where you'll find what. 1. The Navigation Panel on the ...